As the Lunar New Year (Tết Nguyên Đán) approaches, Vietnam transforms into a vibrant celebration of family,...

When a business first enters Vietnam, the immediate goal is usually simple: “We need to pay our...

For many businesses entering or expanding in Vietnam, the “people” aspect of the journey...

The landscape of Personal Income Tax (PIT) in Vietnam is undergoing its most significant transformation...

As we look forward to a brand new year, there is exciting news for employees and businesses across Vietnam....

The momentum of Vietnam’s economic transformation is no longer just a forecast; it is a measurable reality....

As an SME (Small and Medium-sized Enterprise) or a foreign company testing the Vietnamese market, your...

Vietnam’s robust economy and highly engaged, young workforce make it an essential talent market....

As businesses scale and look to tap into the global talent market, the question of how to pay international...

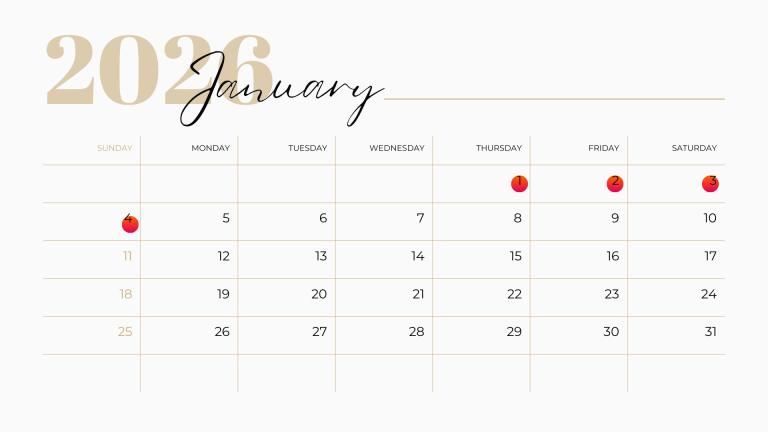

The Prime Minister of Vietnam has officially approved the 2026 Vietnam Public Holidays schedule. This...

Expanding or managing fluctuating workloads in Vietnam requires efficiency and strict compliance. For...

The Vietnam’s 13th Month Bonus is a widely discussed topic in the Vietnamese labor market. While...