Overtime pay in Vietnam is important. To ensure fair compensation for extra hours worked, the government has specific rules. This guide explains how overtime pay works, including conditions and night shift pay. Understanding these rules helps everyone, employers and employees, keep things fair.

Table of Contents

ToggleDefinition of Overtime

Article 107 of the Labor Code 2019 stipulates: “Overtime is the duration of work that the worker performs at any time outside of the normal working hours as stipulated in the law, a collective bargaining agreement or internal work regulations.”

Conditions for Overtime Work

Employers can request employees to work overtime under the following conditions:

- The employee agrees to work overtime.

- Overtime hours do not exceed 50% of normal working hours in a day. If working hours are calculated weekly, total work time, including overtime, cannot surpass 12 hours in a day and 40 hours in a month.

- Total overtime hours must not exceed 200 hours per year, except in cases mentioned in Clause 3 of this Article.

Extended Overtime Hours

In some industries or situations, employers may require up to 300 overtime hours per year. These cases include:

- Manufacturing and processing export products (e.g., textiles, garments, leather, footwear, electronics, agricultural and seafood processing).

- Essential services such as electricity, telecommunications, oil refining, and water supply.

- Jobs requiring specialized skills are scarce in the labor market.

- Urgent tasks are impacted by seasonal factors, timing of materials, or unforeseen events (e.g., weather, fires, or equipment breakdowns).

- Other cases approved by the Government.

Overtime Pay Calculation

(Decree No. 145/2020/ND-CP)

Employees working overtime are entitled to overtime wages based on their hourly wage or the actual wage for their job.

For Time-Based Employees

| Overtime wage | = | Actual hourly wage for regular working hours | X | At least 150%, 200%, or 300% | X | Number of overtime hours |

Where:

- The actual hourly wage excludes bonuses, allowances, and other non-work-related payments.

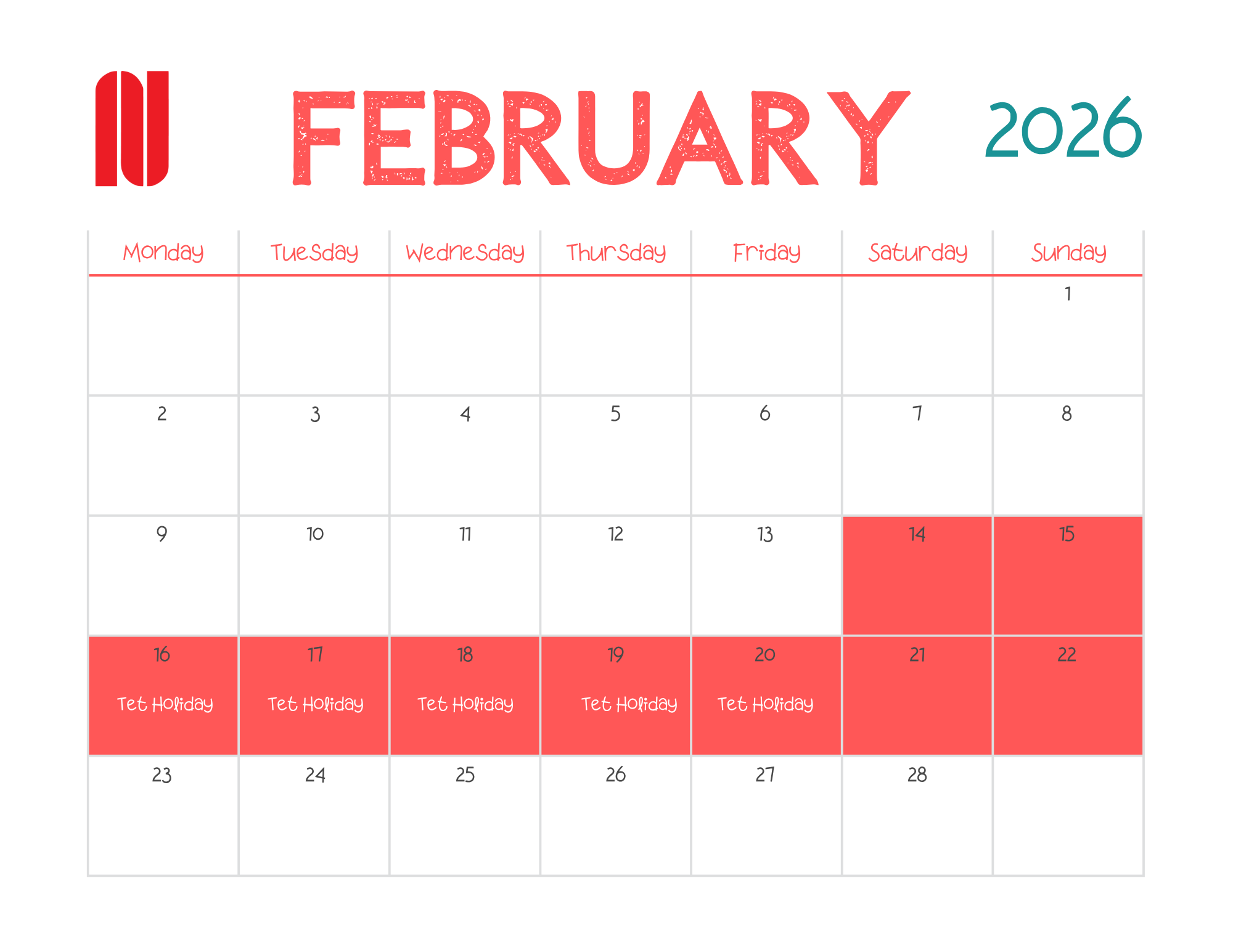

- Overtime pay is at least 150% on a regular workday, 200% on a weekly rest day, and 300% on public holidays, Tet, or other paid leave days.

For Product-Based Employees

| Overtime wage | = | Piece rate for regular workdays | X | At least 150%, 200%, or 300% | X | Number of additional products |

Where: The overtime wage must be at least 150% of the piece rate for regular workdays when the overtime is performed on a regular workday; at least 200% when the overtime is performed on a weekly rest day; and at least 300% when the overtime is performed on public holidays, Tet, or other paid leave days.

Overtime Pay for Night Shifts

Employees working overtime at night, as per Clause 3 of Article 98 of the Labor Code, are entitled to overtime wages calculated using the following formula:

For Time-Based Employees

| Night shift overtime wage | = | Actual hourly wage for regular working hours | X | At least 150%, 200%, or 300% | X | Actual hourly wage for regular working hours | X | At least 30% | + | 20% | X | Daytime wage for regular workdays or rest days | X | Number of night overtime hours |

Where:

- The actual hourly wage for regular working hours is determined as per Clause 1, Article 55 of this Decree.

- The daytime wage for regular workdays or rest days is determined as follows:

- For regular workdays, the wage is at least 100% of the actual hourly wage if no overtime was performed during the day, or at least 150% if daytime overtime was performed;

- For weekly rest days, the wage is at least 200% of the actual hourly wage;

- For public holidays, Tet, or other paid leave days, the wage is at least 300% of the actual hourly wage.

For Product-Based Employees

Night shift overtime wage = Piece rate for regular workdays × At least 150%, 200%, or 300% + Piece rate for regular workdays × At least 30% + 20% × Daytime piece rate for regular workdays or rest days × Number of additional products produced at night

Where:

-

For regular workdays, pay at least 100% of the piece rate if no overtime occurred during the day, or at least 150% if the employee worked daytime overtime.

- For weekly rest days, the piece rate is at least 200%

- For public holidays, Tet, or other paid leave days, the piece rate is at least 300%.

______________

NetViet offers comprehensive HR solutions for businesses entering or expanding in the Vietnamese market. Established in 2000, NetViet provides expert, seamless, and compliant HR solutions.

Legal Disclaimer: The information provided is for general informational purposes only and does not constitute legal advice. For specific legal advice on compliance in Vietnam, schedule a consultation with NetViet or consult legal counsel.

Follow NetViet for the latest industry updates and more:

- Phone: +84 28 6261 7310

- Email: info@netviet.com.vn

- Website: www.netviet.com.vn

- Facebook | LinkedIn | Twitter