In the world of HR and payroll management, one of the most frequently asked questions by employers is: Should we structure salaries based on gross or net pay? While it may sound like a technical choice, the decision between gross and net salary has far-reaching implications—not only for compliance and cost planning but also for employee satisfaction and payroll efficiency.

For growing businesses, especially in emerging markets like Vietnam, optimizing payroll is not just about meeting regulatory requirements. It’s about balancing clarity, cost control, and strategic alignment with your workforce goals. Understanding the impact of your chosen salary format helps ensure smooth operations and better employer-employee transparency.

Table of Contents

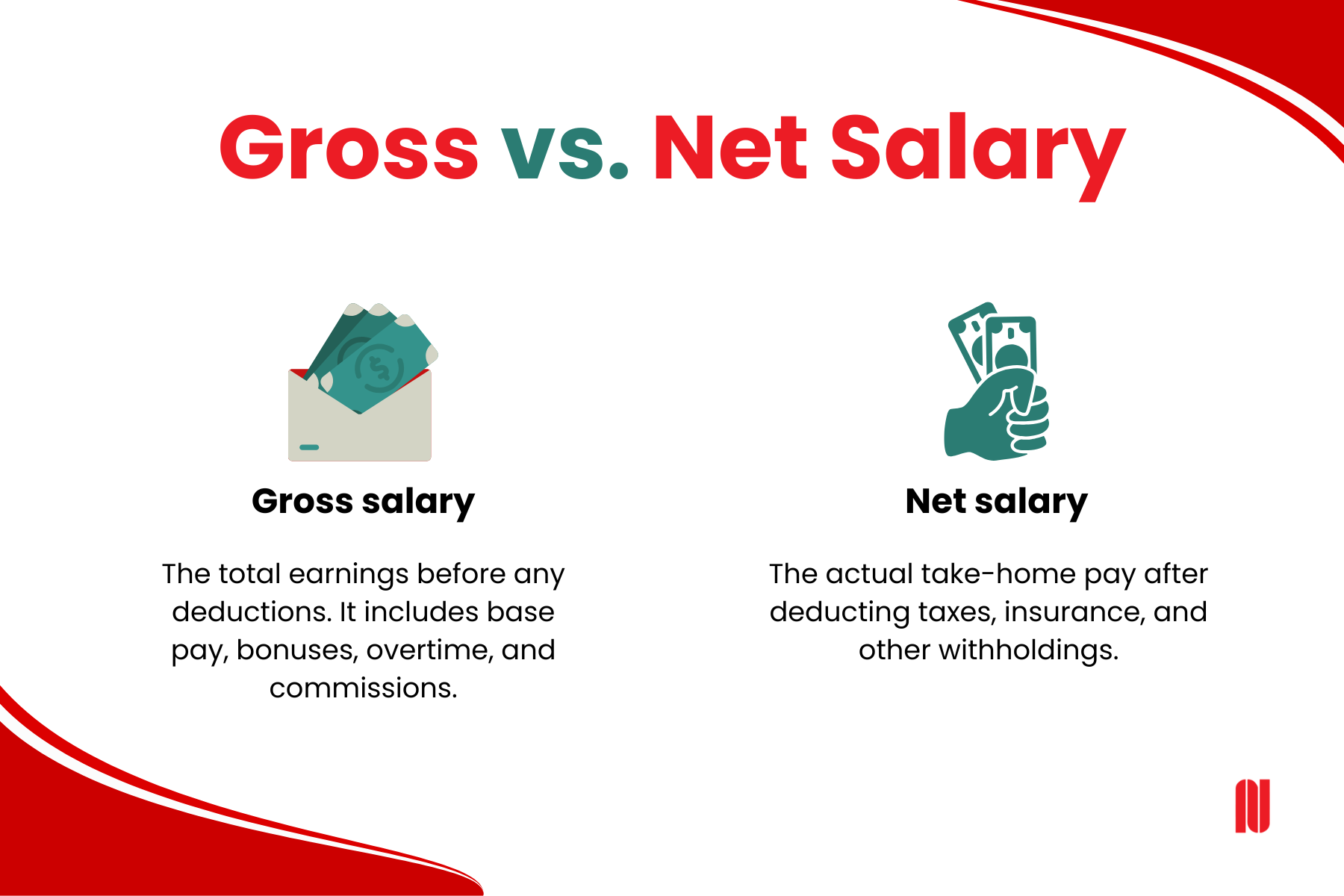

ToggleWhat Is Gross Salary?

Gross salary is the total compensation an employee agrees to receive before any deductions. It includes not just base salary but also allowances, bonuses, and other taxable benefits. In Vietnam, this is the amount stated in the labor contract and used as the basis for calculating statutory contributions and taxes.

Gross salary typically includes:

-

Base salary

-

Allowances (e.g., transportation, meal, housing)

-

Bonuses

-

Overtime payments

-

Any other taxable income

What Is Net Salary?

Net salary is the take-home pay—the actual amount employees receive after all mandatory personal deductions have been subtracted from their gross salary. In Vietnam, these deductions include:

- Social Insurance (SI) – employee’s contribution (8%)

- Health Insurance (HI) – employee’s contribution (1.5%)

- Unemployment Insurance (UI) – employee’s contribution (1%)

- Personal Income Tax (PIT) – calculated progressively based on income

- Union fee (PIT) – employee’s contribution (1%)

So, the formula would be:

Net Salary = Gross Salary – (SI + HI + UI + PIT+ Union Fee)

This is the actual amount employees receive in their bank accounts each pay period.

Gross vs. Net Salary: Key Differences

| Gross Salary | Net Salary | |

| Meaning | Total earnings before taxes and deductions are applied | Final amount received by employees after all deductions |

| Included Elements | Basic wage, overtime pay, bonuses, commissions, and other pre-deduction amounts | Amount after tax, social security, and insurance deductions |

| Typical Value | Always greater than the net pay | Always less than the gross pay |

| Primarily used for | Commonly referenced in job offers, budgeting, and compensation planning | Gives a clear view of take-home pay for personal finance decisions |

| What’s Not Counted | Excludes taxes and statutory contributions | Excludes employer-covered benefits and pre-tax contributions |

Payroll Optimization: Rethinking Salary Structuring

While both gross and net formats serve their purposes, the real optimization happens when employers strategically align their payroll structure with their broader goals. For companies looking to streamline compliance and cost forecasting, gross salary offers a clearer path. It aligns with legal documentation practices and ensures that changes in tax rates or benefits do not unexpectedly impact the employer’s budget.

However, net salary agreements can appeal more directly to candidates who want transparency in what they’ll receive. This can be an advantage when hiring expatriates, high-level professionals, or project-based talent.

Ultimately, the decision should not be based solely on candidate preference or perceived simplicity. Employers must weigh the administrative load, long-term cost implications, and risks tied to fluctuations in insurance or tax laws.

See more: HR Payroll Solutions for SMEs | Eliminate Payroll Delays & Errors

Legal Considerations in Vietnam

Vietnamese labor law favors the use of gross salary in employment contracts. Here’s what you need to consider:

-

The gross salary must be used as the base to calculate PIT, social insurance (SI), health insurance (HI), and unemployment insurance (UI).

-

Employers are required to clearly state both gross and net amounts on payslips to ensure transparency.

-

Failure to comply with salary structure regulations can result in administrative fines or disputes with employees.

-

Any benefits, bonuses, or allowances must also be properly declared and taxed where applicable.

Keeping payroll records transparent and accurate is essential, especially as the legal framework continues to evolve.

Which One Should Employers Choose: Gross Salary or Net Salary?

Choosing between gross and net salary depends largely on your company’s structure, operational goals, and the expectations of your workforce. Each approach offers unique advantages in different contexts.

When to Use Gross Salary?

- You need greater control over statutory compliance: If your HR or payroll team is experienced with labor regulations, gross salary allows you to calculate and withhold taxes and contributions accurately, ensuring full legal compliance.

- You operate in multiple locations or countries: Gross salary provides a standardized basis for comparison, making it easier to align compensation frameworks across different offices.

- You want to simplify salary benchmarking and job offers: Gross figures are often used in job market surveys and internal budgeting, helping with consistent planning and communication.

- Your workforce includes varied roles or pay structures: Gross salary allows flexibility when dealing with overtime, bonuses, and other variable pay components.

When to Use Net Salary?

- You want to prioritize employee clarity and satisfaction: Net salary clearly shows employees what they’ll take home, which reduces confusion—especially among junior staff or roles with less familiarity with payroll deductions.

- You are hiring for roles with high turnover or competitive pressure: Providing a clear, fixed take-home pay can make job offers more attractive in fast-moving sectors like retail, hospitality, or customer service.

- Your company handles payroll through an external provider: If a third party manages compliance and tax obligations, net salary agreements may streamline communication between HR, the provider, and employees.

Follow NetViet for the latest industry updates and more:

- Phone: +84 28 6261 7310

- Email: info@netviet.com.vn

- Website: www.netviet.com.vn

- Facebook | LinkedIn | Twitter