Introduction

Navigating the complexities of payroll in Vietnam can be daunting for businesses, especially when it comes to understanding the SHUI system. SHUI, which stands for Social, Health, and Unemployment Insurance, is a critical component of the Vietnamese payroll system. Ensuring compliance with SHUI regulations is essential not only for legal reasons but also for maintaining employee satisfaction and business reputation.

Contents

ToggleIn this comprehensive guide, we’ll explore what SHUI is, break down its components, explain how contributions are calculated, and discuss the benefits and penalties associated with it. Whether you’re a business owner, HR professional, or employee, this article will provide you with everything you need to know about SHUI and its significance in Vietnam.

Comprehensive Overview of SHUI in Vietnamese Payroll

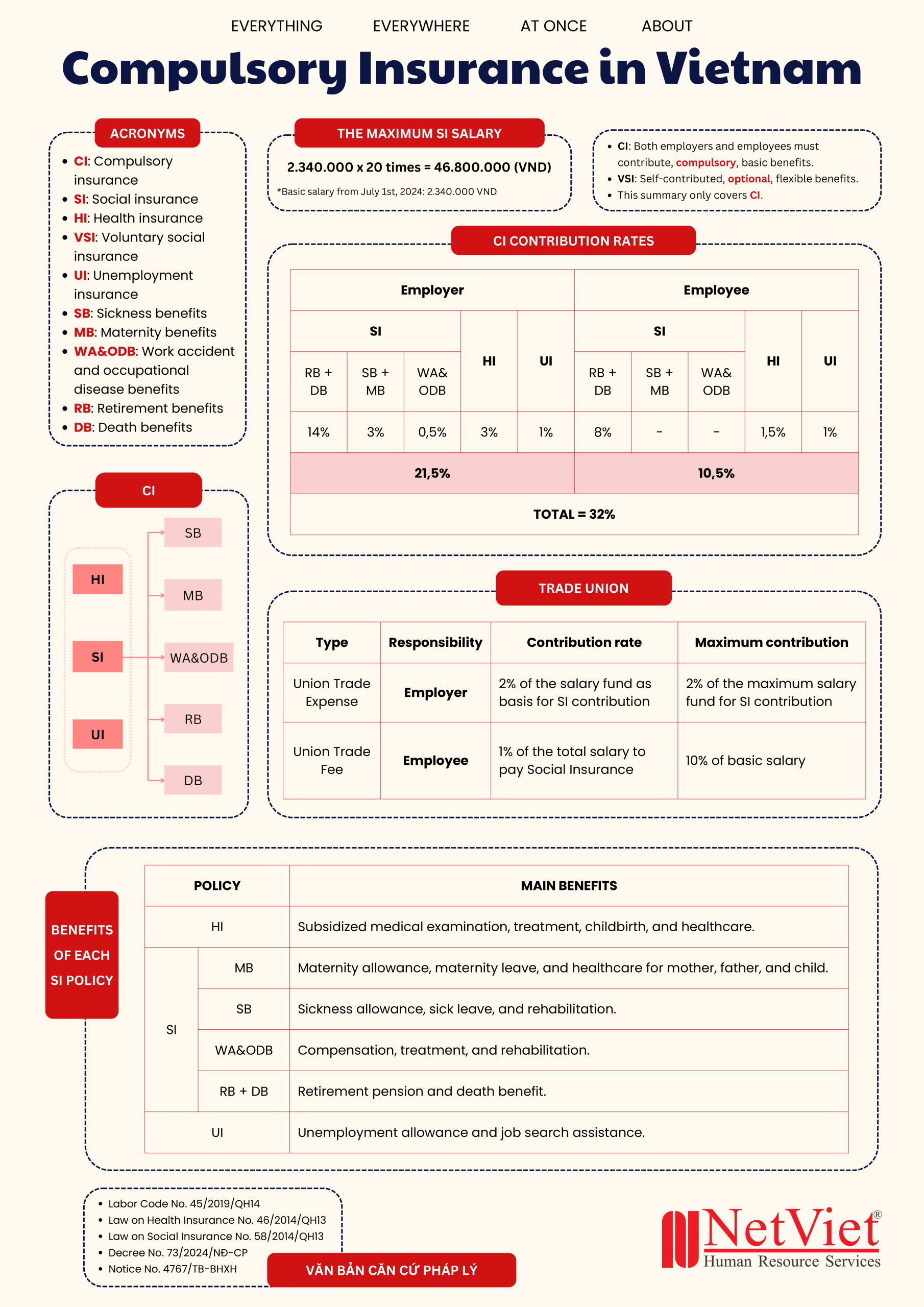

SHUI is a mandatory insurance system in Vietnam, requiring contributions from both employers and employees. This system is designed to provide social security, healthcare, and unemployment support to employees, ensuring they are protected in various life situations. Understanding SHUI is essential for any business operating in Vietnam, as it directly impacts payroll calculations and compliance with local labor laws.

What is SHUI?

SHUI stands for Social Insurance, Health Insurance, and Unemployment Insurance. These three components form the backbone of employee welfare in Vietnam, providing essential benefits such as retirement pensions, medical care, and financial support during unemployment.

Social Insurance (SI): Social Insurance covers a range of benefits, including retirement pensions, sickness and maternity leave, and death benefits. It ensures long-term financial security for employees, particularly as they approach retirement age.

Health Insurance (HI): Health Insurance provides access to medical care, covering both preventive services and treatment for illnesses or injuries. This component is crucial for maintaining the overall health and well-being of employees.

Unemployment Insurance (UI): Unemployment Insurance offers financial support to employees who lose their jobs through no fault of their own. It also provides job training and placement services to help individuals reenter the workforce.

Download NetViet Reference Cheat Sheets about SHUI here.

Components of SHUI

Understanding the individual components of SHUI is key to grasping its overall significance. Let’s break down each component and the benefits it offers.

Social Insurance (SI)

Social Insurance is a mandatory contribution that provides various benefits to employees, including:

- Retirement Pension: Employees who have contributed to Social Insurance for the required number of years are eligible for a pension upon reaching retirement age. This pension is a crucial source of income for retirees in Vietnam.

- Sickness and Maternity Benefits: Social Insurance offers financial support to employees who are unable to work due to illness or maternity. This ensures that employees can take the necessary time off without financial strain.

- Death Benefits: In the event of an employee’s death, their dependents may receive survivor benefits, providing financial security to the family.

Health Insurance (HI)

Health Insurance ensures that employees have access to necessary medical care, including:

- Medical Treatment: Health Insurance covers a wide range of medical services, from outpatient visits to major surgeries. Employees can access these services at public and private healthcare facilities.

- Preventive Care: Health Insurance also covers preventive services, such as vaccinations and regular health check-ups, which are essential for early detection and prevention of illnesses.

Unemployment Insurance (UI)

Unemployment Insurance provides financial assistance to employees who lose their jobs and helps them find new employment through:

- Unemployment Allowance: Employees who qualify for Unemployment Insurance receive a monthly allowance during their unemployment period. This financial support helps cover basic living expenses while they search for a new job.

- Job Training and Placement Services: Unemployment Insurance also offers access to job training programs and employment services, helping employees acquire new skills and find new job opportunities.

Accurate calculation of SHUI (Social, Health, and Unemployment Insurance) contributions is essential for legal compliance and effective payroll management in Vietnam. Both employers and employees are required to contribute, but the contribution rates and the structure are defined by law and must be strictly followed.

Monthly SHUI Contribution Amount = Monthly base Salary X Applicable Contribution Rate (%) for SHUI

FOR COMPULSORY INSURANCE

- The maximum salary cap for Social Insurance is 20 times the basic salary.

- The minimum salary limit for Social Insurance cannot be lower than the regional minimum wage applicable to the employee’s working location.

| Basis for Calculation | Amount (from July 1, 2024) | |

| Maximum salary for SI | 20 × Basic salary | 46,800,000 VND/month |

| Minimum salary for SI | Regional minimum wage | Varies by region (e.g., 4,960,000 VND in Region I) |

Employer Contribution Rates

Employers are responsible for contributing a total of 21.5% of the employee’s monthly salary to the compulsory insurance system, broken down as follows:

| Insurance Type | Employer Rate | Purpose |

| Social Insurance (SI) | 14% | Retirement & Death Benefits (RB + DB) |

| Social Insurance (SI) | 3% | Sickness & Maternity Benefits (SB + MB) |

| Social Insurance (SI) | 0.5% | Work Accident & Occupational Disease Benefits (WA&ODB) |

| Health Insurance (HI) | 3% | Medical, Childbirth, Healthcare |

| Unemployment Insurance (UI) | 1% | Unemployment Allowance & Job Search |

| Total | 21.5% |

Employee Contribution Rates

Employees must contribute a total of 10.5% of their monthly salary, distributed as:

| Insurance Type | Employee Rate | Purpose/Benefit Area |

| Social Insurance (SI) | 8% | Retirement, Sickness, Maternity, Death |

| Health Insurance (HI) | 1.5% | Medical, Childbirth, Healthcare |

| Unemployment Insurance (UI) | 1% | Unemployment Allowance & Job Search |

| Total | 10.5% |

Example Calculation

For an employee with a base monthly salary of 20,000,000 VND:

Employer’s monthly contribution:

- 21.5% x 20,000,000 VND = 4,300,000 VND (This amount cannot be deducted to the employee’s monthly salary)

Employee’s monthly contribution:

- 10.5% x 20,000,000 VND = 2,100,000 VND

FOR TRADE UNION

1. Trade Union Expense: Employers contribute 2% of the SI monthly salary fund to the Trade Union

Example calculation

Contribution for Trade Union Expense:

2% × 20,000,000 VND = 400,000 VND per month

Maximum limit:

2% × 46,800,000 VND = 936,000 VND per month

(If the employee’s SI salary exceeds 46,800,000 VND, the employer only pays up to 936,000 VND)

2. Trade Union Fee: Employees contribute 1% of their monthly salary to the Trade Union

Example calculation

Contribution for Trade Union Fee:

1% × 20,000,000 VND = 200,000 VND per month

Maximum limit:

10% × 2,340,000 VND = 234,000 VND per month

(If the employee’s SI salary is higher than 23,400,000 VND, the employee only pays up to 234,000 VND)

| Rate | Maximum Limit | Minimum Limit | |

| Employer | 2% of salary fund | 2% of the salary fund, with the salary fund capped at 46,800,000 VND/ per employee | Minimum salary fund based on regional minimum wage |

| Employee | 1% of total salary | 10% of basic salary | No fixed minimum; based on actual salary |

Mandatory Contributions and Exemptions

SHUI contributions are mandatory for all employees working under labour contracts in Vietnam. However, there are certain exemptions, such as employees on short-term contracts of less than one-month, foreign employees with specific visa statuses, and workers in sectors exempted by the government. See more about questions that are often asked by employers!

Latest 2025 Social Insurance Regulations

From July 1, 2025 (According to the 2024 Social Insurance Law)

- Social Assistance Pension (state-funded social pension) includes:

- Monthly social pension payments

- Funeral cost support

- Health insurance funded by the state budget for pensioners

- Mandatory Social Insurance now covers:

- Sickness

- Maternity

- Retirement

- Survivorship (death benefits)

- Work-related accidents and occupational diseases (as regulated by the Labor Safety and Hygiene Law)

- Voluntary Social Insurance now includes:

- Maternity benefits

- Retirement

- Survivorship

- Work-related accidents (as regulated by the Labor Safety and Hygiene Law)

- Unemployment Insurance as regulated by the Employment Law.

- Supplementary Retirement Insurance remains regulated separately.

Important updates:

1. The minimum number of years of contribution required to be eligible for a monthly pension has been reduced from 20 years to 15 years, encouraging broader participation.

2. Stricter penalties are applied for late, missed, or evaded social insurance payments, including daily fines and potential criminal liability for serious violations.

Conclusion

SHUI is a crucial aspect of Vietnamese payroll, offering essential benefits to employees. Businesses must understand and comply with SHUI regulations to maintain a positive workforce. By ensuring timely contributions, employers not only fulfill legal obligations but also contribute to employee well-being and long-term business success. SHUI is vital for a supportive work environment in Vietnam.

NetViet offers comprehensive HR solutions for businesses entering or expanding in the Vietnamese market. Established in 2000, NetViet provides expert, seamless, and compliant HR solutions.

CONTACT US NOW for immediate and dedicated service!

__________________________________________________

Notes:

(1) Decree 73/2024/ND-CP, effective from July 1, 2024.

(2) Article 64 of the Law on Social Insurance 2024, effective from July 1, 2025

__________________________________________________

NetViet offers comprehensive HR solutions for businesses entering or expanding in the Vietnamese market. Established in 2000, NetViet provides expert, seamless, and compliant HR solutions.

Follow NetViet for the latest industry updates and more:

- Phone: +84 28 6261 7310

- Email: info@netviet.com.vn

- Website: www.netviet.com.vn

- Facebook | LinkedIn | Twitter